Ohio School Safety and Security Grant (SSSG) for HVAC Improvements

The Ohio BWC has expanded the School Safety and Security Grant (SSSG) to help cover the costs of improvements to heating, ventilation and air conditioning (HVAC) systems. Grant funding of $15,000 is available to any qualifying entity under the SSSG program to cover the cost of inspections, assessments, maintenance and improvements to HVAC systems as well as the purchase of other secondary devices to control the spread of airborne contaminants. Learn more about the CARES Act and HVAC opportunities here.

Learn more about HVAC depreciation, equipment life expectancy, and maintenance management from these resources online.

ASHRAE – ASHRAE chart of HVAC Equipment Life Expectancy

IRS – More information on depreciation can be found on the IRS website

ASHRAE – Current data and information can be found on the ASHRAE Service Life and Maintenance Cost Database

Our preventative maintenance program combined with these tax strategies creates an opportunity to invest in your business with the savings generated.

Contact Us Here for a System Analysis to help you find that freedom that comes with increased cash flow!

*Consult with your CPA firm to make sure the application is best for your specific business case.

HVAC Equipment Depreciation: Repair or Replace?

Although proper preventative maintenance of your building’s HVAC system will result in efficient performance and help extend its service life, there will inevitably come a time when you need to consider the economic and accounting benefits of replacing aging, depreciating equipment with a new heating

and air-conditioning system.

The CARES Act and HVAC

The CARES Act contains several tax savings benefits for businesses, including specific terms for HVAC and HVAC depreciation life – with the goal of enhancing Indoor Air Quality (IAC).

For example, under Section 168 of the tax code, the cost of all equipment and components of the “heating, ventilating, and air conditioning system” may be fully deducted for tax purposes in the first year. The CARES Act reduces the depreciation schedule to 15 years and creates a bonus depreciation that allows the taxpayer to take a full deduction of certain costs in a single year. The 100% bonus depreciation applies to qualified property acquired and placed in service before January 1, 2023*.

"The CARES Act reduces the depreciation schedule to 15 years and creates a bonus depreciation that allows the taxpayer to take a full deduction of certain costs in a single year."

We solve commercial HVAC and plumbing problems that others can’t. Whether it’s complex system challenges, outdated infrastructure, or urgent repair needs. Our expert team also helps you stay ahead with energy-efficient solutions that reduce operating costs and improve long-term performance.

Get to Know Our Team

Meet the Experts Behind the Work

Our team brings decades of experience in HVAC, plumbing, and energy solutions. Get to know the people who keep your building running at peak performance.

-

Kris Campbell Principal

Kris Campbell Principal -

Pete Vavrinek VP & CFO

Pete Vavrinek VP & CFO -

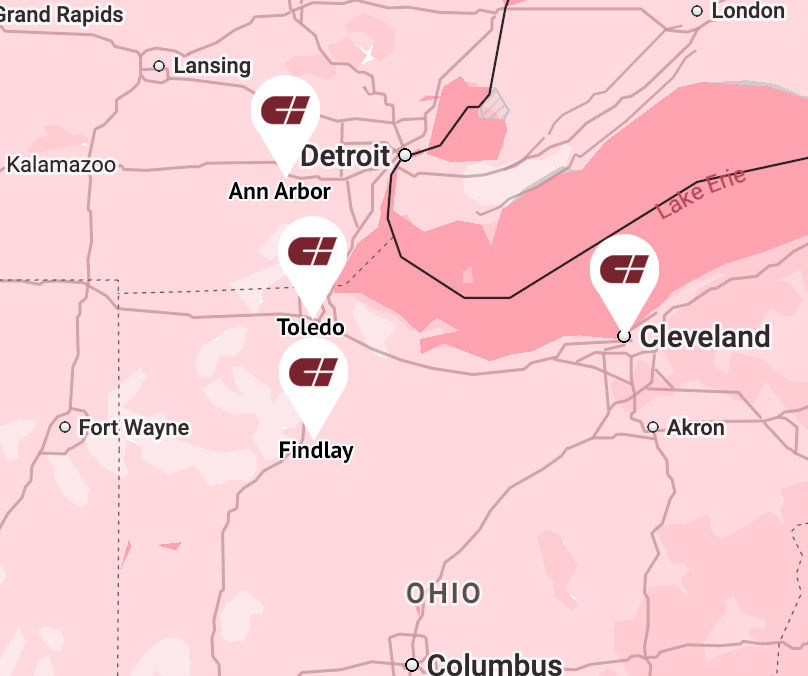

Todd (Lumpy) Kocsis General Manager Toledo

Todd (Lumpy) Kocsis General Manager Toledo -

Shanna Warner General Manager Ann Arbor

Shanna Warner General Manager Ann Arbor -

Jim Ingersoll General Manager Cleveland

Jim Ingersoll General Manager Cleveland -

Andrew Hoverson New Business Development

Andrew Hoverson New Business Development -

Bryan Mallette Sales Manager

Bryan Mallette Sales Manager -

Dave Mobus Service Quote Specialist

Dave Mobus Service Quote Specialist -

David Solomon Maintenance Sales

David Solomon Maintenance Sales -

Jennifer Natale New Business Development

Jennifer Natale New Business Development -

Jonathan Radtke Service Manager

Jonathan Radtke Service Manager -

Katie Clouse Service Coordinator

Katie Clouse Service Coordinator -

Kelley Thomas Project & Maintenance Sales

Kelley Thomas Project & Maintenance Sales -

Kevin Coakley Project Sales

Kevin Coakley Project Sales -

Laurie Long New Business Development

Laurie Long New Business Development -

Leo Bower Dispatch

Leo Bower Dispatch -

Nick Fling Project Sales Associate

Nick Fling Project Sales Associate -

Penny Goodman Dispatch

Penny Goodman Dispatch -

Wayne Lemke Project Sales

Wayne Lemke Project Sales -

Cyndi Kidd Maintenance Sales Representative

Cyndi Kidd Maintenance Sales Representative -

John Dilworth Maintenance Sales Representative

John Dilworth Maintenance Sales Representative -

Justin Moneypenny Project Sales

Justin Moneypenny Project Sales -

Jim Cooper Project Sales Associate

Jim Cooper Project Sales Associate

.2511241237288.jpg)